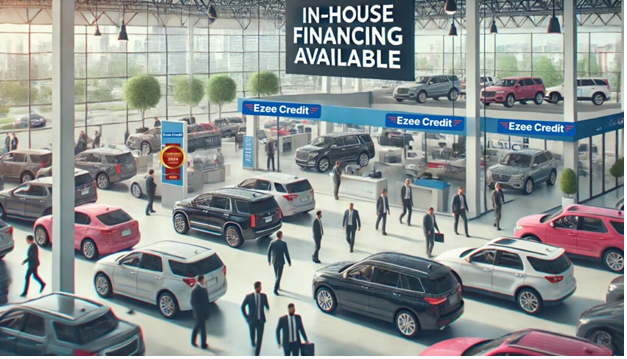

Many individuals find having a car to be necessary as it provides flexibility and convenience for commuting, working, and enjoying their personal lives. However, obtaining financing to purchase a vehicle can be difficult if you have bad credit. Thankfully car dealerships with in-house finance, often referred to as “buy here, pay here” dealerships, provide solutions aimed at people with less-than-perfect credit.

These dealerships handle both the auto sale and the financing in a single location, making the process more seamless and more accessible for people with poor credit.

This guide will explain how in-house financing works, the benefits it offers, and the main factors to consider when choosing a dealership.

What Is In-House Financing?

On-site financing is a financial option given by car dealerships. Instead of trusting third-party lenders, the car seller acts as the creditor, setting the loan terms and arranging repayment.

How It Works

Vehicle Selection: The buyer selects an automobile from the dealership’s stock.

Loan Application: The dealership looks into the buyer’s financial status and credit history.

Loan Approval: Approval is often quicker and less stringent than with traditional lenders.

Repayment: Payments are made directly to the dealership, often weekly or bi-weekly.

Benefits of In-House Financing

Accessibility for Bad Credit Borrowers

Traditional lenders frequently need a solid credit score to approve auto loans. However, in-house finance companies specialize in dealing with clients with bad or no credit. This inclusivity makes car ownership possible for many who might otherwise be denied.

Faster Approval Process

Since the dealership controls the financing process, approvals are typically quicker. Buyers can often drive away the same day they apply for financing.

Opportunity to Rebuild Credit

Many in-house financing dealerships report payments to credit bureaus. By making timely payments, borrowers can improve their credit scores over time.

Simplified Process

With everything handled in one place—car purchase, financing, and payments—the process is straightforward and convenient for buyers.

Potential Downsides of In-House Financing

Higher Interest Rates

In-house financing frequently has higher interest rates than standard auto loans. This compensates for the greater danger of lending to people who have unfavorable credit.

Limited Vehicle Selection

The inventory at buy here, pay here dealerships may be smaller or consist mainly of used vehicles.

Strict Repayment Terms

Payments are typically required weekly or bi-weekly, and missing a payment can lead to repossession more quickly than with traditional loans.

How to Find Car Dealerships with In-House Financing

Online Research

In-house financing frequently has higher interest rates than common auto loans. This compensates for the higher risk of lending to people who have a loss of credit.

Recommendations

Ask friends, family, or local community groups for recommendations of reputable dealerships.

Check Reviews

Online reviews on Google or Yelp provide insights into customer experiences, helping you avoid predatory dealers.

Verify Licensing

Ensure the dealership is licensed and has a good reputation with local consumer protection agencies or the Better Business Bureau (BBB).

Key Considerations Before Choosing a Dealership

Understand Loan Terms

Read the loan terms carefully, keeping notes of the fascination rates, payment plan, and any late payment penalties.

Budgeting

Make sure the monthly payment falls within your budget. A good rule of thumb is to limit car expenses to 15% of your monthly income.

Vehicle Inspection

If feasible, have an independent mechanic evaluate the car to ensure it is in good shape.

Down Payment

Many in-house financing dealerships require a down payment. Prepare to pay upfront to secure the car.

Tips for a Successful Experience with In-House Financing

Make Payments on Time

Making timely payments is essential for avoiding repossession and boosting your credit score if the dealership reports to credit bureaus.

Negotiate Terms

Do not grow frightened to negotiate. Some dealerships may be ready to modify interest rates or payback strategies according to your needs.

Avoid Overpaying

To prevent overpaying, research the car’s market value before agreeing to the dealership’s pricing.

Ask About Credit Reporting

Confirm whether the dealership reports payments to credit bureaus. This can be a significant factor in rebuilding your credit.

Popular Car Dealership Chains Offering In-House Financing

DriveTime

- Specializes in financing for individuals with bad credit.

- Offers a large inventory of used vehicles.

CarHop

- Focuses on helping those with poor credit secure financing.

- Provides a warranty and customer protection plan with purchases.

JD Byrider

- Combines a selection of certified vehicles with in-house financing options.

- Reports payments to credit bureaus, helping buyers improve their credit.

Local Buy Here, Pay Here Dealers

- Many independent dealerships offer similar services. Research local options to find the best deal.

Conclusion

Car shops that offer in-house financing are a good alternative for people with poor credit because they provide easy ways to get a car. While the procedure has certain challenges, such as higher interest rates and limited inventory, the positives, particularly the ability to restore credit, often exceed the drawbacks. By completing careful research, negotiating circumstances, and making timely payments, you can use in-house finance as a stepping stone to greater financial security and reliable transportation.

If you’re dealing with bad credit, know that with patience, research, and the appropriate dealership, you may still own a car.

FAQs

Do you build credit with in-house financing?

Many people believe that in-house financing does not boost their credit scores, although this is not necessarily the case. Depending on where you buy your automobile, this form of loan can help you boost your credit score in a variety of ways.

Why is financing better?

Financing options break down the cost into manageable installments, reducing the initial financial burden for the consumer and making the purchase more affordable.

How do I avoid predatory dealerships?

Research reviews, verify licensing, and carefully review loan terms to avoid predatory practices. Trust your instincts and walk away if a deal feels too good to be true.

What is in-house financial?

In-house financing is a type of seller financing in which a firm extends customers a loan, allowing them to purchase its goods or services. In-house financing eliminates the firm’s reliance on the financial sector to provide the customer with funds to complete a transaction.

How does pay later work?

It allows the customers to borrow an amount up to the maximum limit set by the bank and repay the same within 45 days without paying any interest. A daily penal interest would only be charged on the total outstanding if the customer fails to repay the borrowed amount by the due date.